Interactive Income Prescient Fund

Investment and Return Objective

The fund aims to return CPI + 3% per annum through a full interest rate cycle while providing stability by aiming never to lose capital over any rolling 3 month period.

Investment Process

This fund invests in local and offshore money markets, bonds, property, preference shares, inflation-linked bonds and derivatives to meet the investment objectives. Fund performance can be generated from taking interest rate views or duration, yield enhancement via credit instruments, asset allocation between income producing asset classes, offshore exposure and also via the use of derivatives.

Bonds | Money Market | Property | Preference Shares | Inflation Linked Bonds | Derivatives

Monthly Income Distributions

Receive Income

Investors can select to receive monthly income payouts to their transactional bank accounts.

OR

Reinvest Income

Investors can reinvest income payouts back into the fund and potentially enhance the compounding effect of returns overtime.

Receive Income

Investors can select to receive monthly income payouts to their transactional bank accounts.

OR

Reinvest Income

Investors can reinvest income payouts back into the fund and potentially enhance the compounding effect of returns overtime.

Investors can select to receive monthly income payouts to their transactional bank accounts.

Investors can reinvest income payouts back into the fund & effectively buy more units to potentially enhance the compounding effect of returns over time.

The fund is suitable for the following investors:

Withdrawals are easy and portfolios are liquid

Liquidity is the rate at which an asset can be converted into cash. Unlike selling a property which takes months, if not years, unit trusts (funds) can be sold or turned into cash within a few business days. This means it’s quick and easy to withdraw the investment.

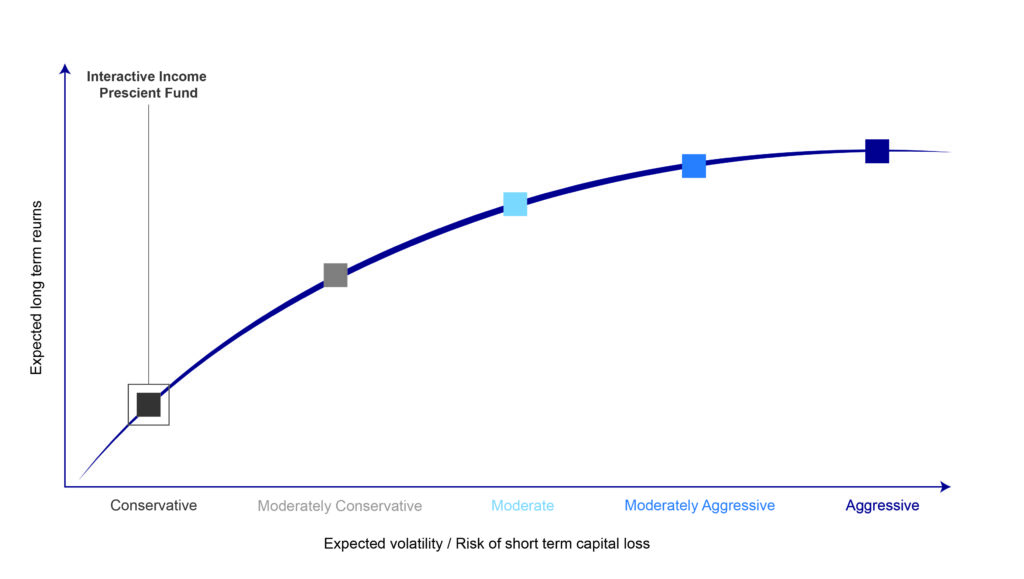

Risk Profile

Risk indicator definition

These portfolios typically have no or low equity exposure, resulting in higher interest yields and stable capital values with the probability of capital losses over the shorter term (3 months) highly unlikely. These portfolios typically target returns in the region of 1% – 3% above inflation before tax over the long-term.

Setup an investment account and select a investment portfolio that is suited to your required return and risk profile.

Disclaimer

Interactive Portfolios (Pty) Ltd is an authorised financial services provider (FSP 44371). Collective Investment Schemes in Securities (CIS) should be considered as medium to long term investments. The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. A schedule of fees, charges and maximum commissions is available on request from the Manager. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. Performance has been calculated using net NAV to NAV numbers with income reinvested. There is no guarantee in respect of capital or returns in a portfolio. Where a current yield has been included for Funds that derive its income primarily from interest bearing income, the yield is a weighted average yield of all underlying interest-bearing instruments as at the last day of the month. This yield is subject to change as market rates and underlying investments change. Prescient Management Company (RF) (Pty) Ltd is registered and approved under the Collective Investment Schemes Control Act (No.45 of 2002). For any additional information such as fund prices, fees, brochures, minimum disclosure documents and application forms please go to www.prescient.co.za