Interactive Global Equity Prescient Fund of Funds

Investment and Return Objective

The fund’s goal is to deliver returns in excess of the benchmark (ASISA) Global EQ General Category Average over a long-term horizon. The fund aims to achieve this goal by investing in funds that invest predominantly into global equities.

The fund is suitable for the following investors:

Who want to invest offshore

Who want to invest in global shares to grow your capital over the long term and receive dividend income

Who are comfortable with the risks associated with global stock market & currency movements as well as experiencing downside volatility

Who have at least a 5-year investment horizon

Investment Strategy

The investment strategy is to deliver long term capital growth and maintain healthy dividend yields for investors.

The fund of funds is a multi-strategy global equity portfolio and is exposed to all of the risk and rewards of global equity markets. The fund is rebalanced quarterly and strategically weights ETFs with different management strategies:

Dividends

A diversified selection of companies that have consistently grown dividend payouts to investors and that have strong fundamentals relative to peers

Wide Moat

A diversified selection of stocks that have a distinct competitive advantage over their competitors and that trade at a discount to fair value (margin of safety)

Quality

A diversified selection of stocks that have historically experienced strong and stable earnings and low debt

Market Capitalisation Index

Companies are weighted in the portfolio as a percentage of their size in market capitalisation

Dividend Income

Receive Income

Investors can select to receive bi-annual dividend payouts to their transactional bank accounts.

OR

Reinvest Income

Investors can reinvest dividends payouts back into the fund & effectively buy more units to potentially enhance the compounding effect of returns over time.

Receive Income

Investors can select to receive bi-annual dividend payouts to their transactional bank accounts.

OR

Reinvest Income

Investors can reinvest dividends payouts back into the fund & effectively buy more units to potentially enhance the compounding effect of returns over time.

Investors can select to receive bi-annual dividend payouts to their transactional bank accounts.

Investors can reinvest dividends payouts back into the fund & effectively buy more units to potentially enhance the compounding effect of returns over time.

Withdrawals are easy and portfolios are liquid

Liquidity is the rate at which an asset can be converted into cash. Unlike selling a property which takes months, if not years, unit trusts (funds) can be sold or turned into cash within a few business days. This means it’s quick and easy to withdraw the investment.

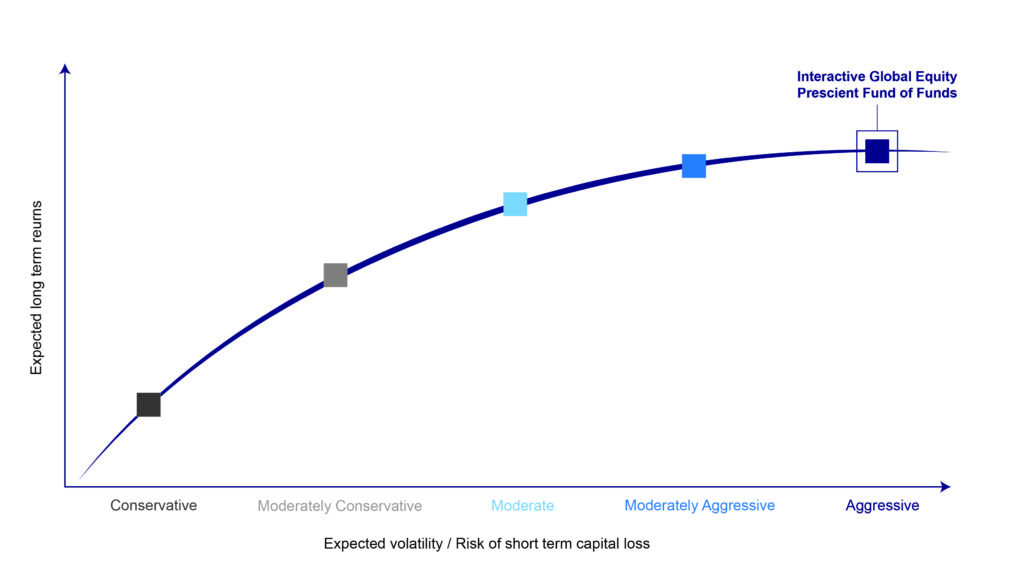

Risk Profile

Risk indicator definition

These portfolios typically hold meaningful equity and/or offshore exposure, which may result in significant capital volatility over all periods. Due to their nature expected long-term returns are higher than for the other risk categories

Setup an investment account and select a investment portfolio that is suited to your required return and risk profile.

Disclaimer

Interactive Portfolios (Pty) Ltd is an authorised financial services provider (FSP 44371). A Fund of Funds is a portfolio that invests in portfolios of collective investment schemes, which levy their own charges, which could result in a higher fee structure for these portfolios. Collective Investment Schemes in Securities (CIS) should be considered as medium to long-term investments. The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. A schedule of fees, charges and maximum commissions is available on request from the Manager. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. Performance has been calculated using net NAV to NAV numbers with income reinvested. There is no guarantee in respect of capital or returns in a portfolio. Prescient Management Company (RF) (Pty) Ltd is registered and approved under the Collective Investment Schemes Control Act (No.45 of 2002). For any additional information such as fund prices, fees, brochures, minimum disclosure documents and application forms please go to www.prescient.co.za