Interactive Equity Prescient Fund of Funds

Investment Objective

At Interactive Portfolios, we believe great businesses create great returns. The Interactive Equity Prescient Fund invests in high-quality South African companies at attractive valuations, with a disciplined, long-term approach designed to grow investors’ capital.

The fund is an actively managed general equity portfolio designed to maximize total returns by strategically investing in companies listed on the Johannesburg Stock Exchange (JSE) and other approved exchanges.

Its primary objective is to deliver medium to long-term capital growth by investing in businesses with strong fundamentals and sustainable growth potential.

The fund is suitable for investors who:

Believe in the long-term growth potential of South African companies.

Seek capital appreciation over the medium to long term.

Are comfortable with short-term equity market volatility.

Prefer a locally focused, actively managed equity strategy.

Investment Policy & Strategy

The fund follows a value-oriented investment philosophy, focusing on companies trading below their intrinsic value or demonstrating strong capital appreciation potential.

Minimum 80% of the fund’s net asset value is invested in South African equity securities.

Up to 20% may be held in money market instruments, cash, or short-term investments, particularly during times of high volatility or when opportunities are limited.

The portfolio is actively managed to adapt to changing market conditions while maintaining disciplined stock selection and sector diversification.

This strategy provides investors with broad exposure to South Africa’s equity markets and positions them to benefit from the long-term growth of leading businesses.

Income & Liquidity

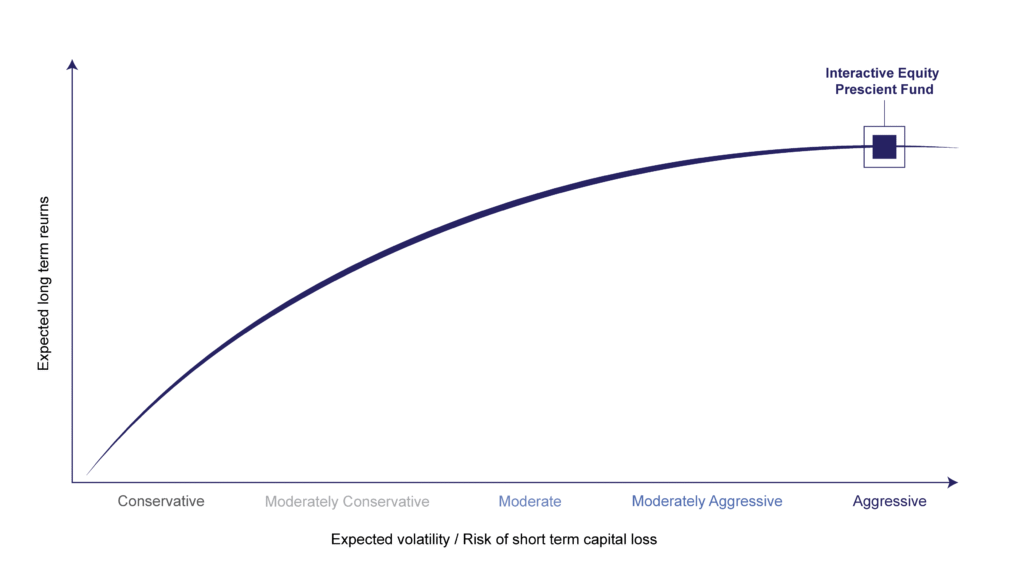

Risk Profile

Risk indicator definition

This fund is classified as high risk due to its equity exposure.

- Investors should expect periods of volatility.

- Over the long term, the fund aims to deliver higher returns through disciplined stock selection and sector diversification.

Set up an investment account and select an investment portfolios that is suited to your required return and risk profile

Disclaimer

Interactive Portfolios (Pty) Ltd is an authorised financial services provider (FSP 44371). A Fund of Funds is a portfolio that invests in portfolios of collective investment schemes, which levy their own charges, which could result in a higher fee structure for these portfolios. Collective Investment Schemes in Securities (CIS) should be considered as medium to long-term investments. The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. A schedule of fees, charges and maximum commissions is available on request from the Manager. A CIS may be closed to new investors in order for it to be managed more efficiently in accordance with its mandate. Performance has been calculated using net NAV to NAV numbers with income reinvested. There is no guarantee in respect of capital or returns in a portfolio. Prescient Management Company (RF) (Pty) Ltd is registered and approved under the Collective Investment Schemes Control Act (No.45 of 2002). For any additional information such as fund prices, fees, brochures, minimum disclosure documents and application forms please go to www.prescient.co.za